| Plastics News |

Italian Amaplast holds General Assembly and celebrates 60 years of activity

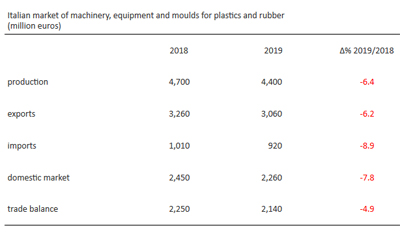

September, 24, 2020 - Amaplast - the national trade association, member of Confindustria, of over 160 Italian manufacturers of plastics and rubber processing machinery, equipment, and moulds - held its annual member Assembly on Wednesday, 16 September 2020 at Villa Borromeo in Cassano d'Adda. The Assembly also provided the opportunity to celebrate Amaplast's sixtieth anniversary. This is an important milestone for an organization that represents one of the preeminent segments of the mechanical engineering industry in Italy. Some of the companies that took part in founding the association on 27 September 1960 are still active members, flanked by others who have joined over the decades and strengthened its identity. Amaplast President Dario Previero made a point of emphasizing that this anniversary does not represent a point of arrival, but an intermediate stage, with the objective to continue growing in an increasingly competitive and globalized market. The new Articles of Incorporation were approved during the Assembly, aligning with the new unified regulations for the Confindustria system, and the Amaplast associative bodies were newly elected: Board of Directors, with the election of Michele Bandera (COSTRUZIONI MECCANICHE LUIGI BANDERA), Maria Grazia Colombo (BFM), Gianni Luoni (ELBA), Alessandro Balzanelli (F.B. BALZANELLI), Barbara Ulcelli (IMG), Luciano Gallino (MARIS), Claudia Persico (PERSICO), Gianfranco Cattapan (PLASTIC SYSTEMS), Corrado Zanga (UNILOY ITALIA), for a two-year term in 2020-2022 Board of Arbitrators, with the election of Andrea Mariani (HENNECKE-OMS), Simone Maccagnan (MAC.GI), Maurizio Toniato (MOBERT), Flavio Giordani (PLASTIBLOW), Romeo Varisco (TERMOSTAMPI), and Board of Auditors, with the election of Gianni Cazzulo (dottore commercialista), Claudia Cribiù (CRIZAF), Roberta Rivi (RIVI MAGNETICS) for four-year terms in 2020-2024. In his speech, President Dario Previero illustrated the performance of the Italian plastics and rubber processing machinery, equipment, and moulds industry, commenting on the reports by the Amaplast Statistical Studies Center and acknowledging that the eight-year upward trend for the industry had come to halt and that 2019 had closed negatively. President Previero also mentioned the synergetic project that Amaplast has recently undertaken with Acimac (Association of Italian Manufacturers of Machinery and Equipment for Ceramics) and Ucima (Italian Packaging Machinery Manufacturers Association). The project will make it possible to further improve the quality of services offered to member companies (from credit and finance to training, from technical issues to promotion, and much more), sharing the competencies, services, and experience of each. A report was presented during the public session after the Assembly titled "Millennials: a generation without a future... and without plastic?" Of great current relevance, it focuses on the new generations, what they think, how they move, and their opinions on plastic. This was followed by a round-table discussion "Plastic: its future in a circular world". The event concluded with a gala dinner to celebrate the association's 60th anniversary and a show by the comedian Andrea Pucci. Round-table discussion "Plastics: its future in a circular world" The public session featured a round-table discussion titled "Plastic: its future in a circular world" with the participation of Marco Fortis, Vice President of Fondazione Edison, Giorgio Quagliuolo, President of COREPLA, Gabriele Molari, Marketing Services Innovation Manager for Tetra Pak Packaging Solutions, and Guido de Vecchi, General Manager of the Intesa Sanpaolo Innovation Center. Professor Fortis illustrated the challenging global economic context and the opportunities that may be created for Italy through opportune use of the European economic recovery funds to reverse the trend caused by the pandemic. He then focused on the performance of the Italian plastics-rubber-machinery-moulds industry chain, pointing out Italy's strengths as a manufacturing country, particularly its growing stature in mechanical engineering, with a powerful innovative and competitive thrust on international markets. President Quagliuolo emphasized the contradiction in the dual taxation system ("plastic tax") that should enter into force in Europe and Italy on 1 January 2021, given that "the world cannot live without plastic." It is an indispensable material in our daily lives, but it is essential to raise consumer awareness that improper disposal of plastics causes both environmental and economic problems. In short: the key is education, not taxation. Gabriele Molari shared his perspectives on the future of plastic packaging. On the one hand, it is a powerful vehicle for valorising brands and communicating messages, on the other, it ensures convenience and simplicity of use. Innovation thus takes us from the concept of a simple product to that of a service, with solutions that must be sustainable across the board. Guido de Vecchi discussed banking initiatives to support Italian businesses in coping with the impact of the pandemic. Beyond financial support for existing businesses, Intesa Sanpaolo is working on the creation of dedicated funds for start-ups and innovative enterprises that can offer an effective contribution to the development of the circular economy. Amaplast and Youth The round table followed a talk by Ilaria Vesentini, Managing Director of MECS, the economic study center for Acimac and Ucima, two associations with which Amaplast has recently established close collaborations. The report "Millennials: a generation without a future... and without plastic?" focuses on the new generations, what they think, how they move, and their opinions on plastics. The study by MECS shows that the younger members of society, who naturally tend to get their information via virtual channels, would like to be better informed of the sustainability of their own consumption habits. As regards plastics, and plastic packaging in particular, their perception is not yet "mature" and it is thus indispensable to ensure accurate and widespread information on how plastic can be used and, most importantly, recycled within the perspective of the circular economy. To this purpose, Amaplast has implemented a series of initiatives to help young people become better acquainted with the plastics and rubber sector. In addition to new accounts on Facebook and Instagram (joining the long established ones on LinkedIn, Twitter, and YouTube), the final editing work is being done on videos that will be posted on social media to open a communication channel and help acquaint people with the sector and the advantages that companies can offer. It is not always easy for these companies to find engineers and specialized technicians to hire. Graduates from engineering schools, technical schools, and higher technical institutes are often more attracted to large corporations or multinationals, which are more appealing in many ways than the small and medium businesses characterizing the Italian industrial machinery engineering industry. A prize competition will also be instituted among technical schools, supported by tutoring programmes offered by Amaplast member companies. These initiatives were introduced by a video campaign - addressed to young people and a lay audience generally - on plastics and rubber processing technologies within a circular economy perspective, produced by Amaplast over the past weeks. Sector Data In his speech, Amaplast President Dario Previero illustrated the performance of the Italian plastics and rubber processing machinery, equipment, and moulds industry, commenting on the reports by the Amaplast Statistical Studies Center and acknowledging that the eight-year upward trend for the industry had come to halt and that 2019 had closed with all indicators in the red.

The signs of an imminent reversal of trend had begun to be seen at the end of 2018, when growth in production was fractional and exports had already begun to decline, albeit only slightly. During the following year, the trend in foreign trade remained constantly negative, especially as regards imports, although the downturn at the end of 2019 was not as bad as had been feared. In any case, the 2019 balance for Italian manufacturers is in line with that of their German competitors, who recorded a drop of 5% in imports and 7% in exports. A host of economic and commercial uncertainties came one after another or overlapped during the final months of 2019, putting a chill on domestic investment, partly attributable to the drying up of Industry 4.0 effects and changes in the dynamics of Italian exports for the sector, which, on the average, continue to represent approximately 70% of production. President Previero underscored the fact that, on the average, Amaplast member companies suffered less than the rest of the industry, with a drop in revenues on the order of 5% and of exports of 2.5%. Of course, this was the situation prior to the COVID-19 emergency, where Italy and the rest of the world were suddenly forced to cope with an unprecedented situation. It is difficult to make projections as to how the crisis will proceed, much less what impact it will have on Italian manufacturers of plastics and rubber processing machinery. On the basis of studies undertaken by the association, accounting for the variables that characterize the sector, it is expected that the current year will close with a reduction in orders of 20-25%. VDMA, the association representing the German competitors, has forecast a similar contraction in orders, even adjusting the figure last month (August 2020) to -30%. ISTAT statistics for Italian foreign trade in the sector in the first half of 2020 show double-digit drops in both trade flows compared to the same period in 2019: -17.6% for imports and -21.7% for exports. However, this represents a slight improvement with respect to data for May, when the respective figures were over 18% and approaching 23%. This mid-year balance certainly comes as no surprise given the complex economic context in which Italian machinery manufacturers have to operate, given the pandemic. But the slight reversal of trend may corroborate the latest forecasts by ISTAT and Confindustria, together with other organizations, which detect in the last few weeks some recovery (albeit small) for Italian industrial production in a situation that is still very complicated. A look at the macro-geography of Italian exports for the sector provides little comfort, with the historically principal outlet markets showing double-digit declines:

Source: Amaplast |