Report by PLASTICS Does Show Increases in Some Areas

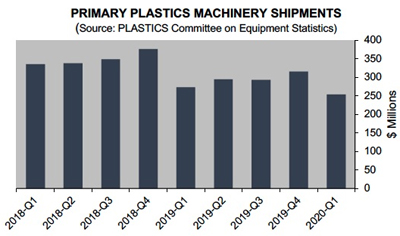

May, 26, 2020 —The shipments of primary plastics machinery (injection molding and extrusion) in North America decreased in the first quarter, according to the statistics compiled and reported by the Plastics Industry Association's (PLASTICS) Committee on Equipment Statistics (CES).

The preliminary estimate of shipments value from reporting companies in the first quarter totaled $254 million, 19.6% decrease, following a 7.7% increase in the fourth quarter of last year. The value of shipments of plastics machinery in the first quarter was 6.9% lower than the first quarter last year.

While the total value of shipments decreased in the first quarter, single-screw extruders shipments rose by 15.5%. Shipments of twin-screw extruders declined marginally by 0.8%. Compared to the first quarter of 2019, the value of single-screw and twin-screw extruders were significantly higher by 34.9% and 19.3%, respectively. Injection molding equipment shipments' value, however, fell 23.6% from the previous quarter and decreased 11.8% from a year ago.

"The first quarter shipments were expected to come in lower due to the coronavirus shutdowns in March. Nevertheless, we saw robust growth in single-screw and twin-screw shipments on a year-over-year basis," according to Chief Economist of PLASTICS Perc Pineda, PhD.

CES also conducts a quarterly survey of plastics machinery suppliers, regarding present market conditions and future expectations. In the coming quarter, 18.5% of respondents expect conditions to either improve or hold steady in the next quarter—lower than the 69.4% that felt similarly in the fourth quarter last year. As for the next 12 months, 22.6% expect market conditions to be steady-to-better, down from 73.5% in the previous quarter's survey.

"The coronavirus pandemic continues to disrupt the manufacturing and service sectors of the economy, both impacted by the plastics industry. However, the demand for plastics remains fundamentally healthy, particularly in the medical and consumer essentials spaces, and the economic slowdown is transitory," Pineda added.

Plastics machinery exports in the first quarter totaled $358.5 million—a 1.6% increase from the previous quarter. Imports rose by 0.5% to $746.3 million, resulting in a trade deficit of $387.8 million, 0.6% lower than the fourth quarter last year. The U.S. continues to rely on Mexico and Canada as its first and second largest plastics machinery export markets. Combined exports to the USMCA trade partners totaled $153.4 million, 42.8% of total U.S. plastics machinery exports.

The PLASTICS Committee on Equipment Statistics (CES) collects monthly data from manufacturers of plastic injection molding, extrusion, blow molding, hot runners and auxiliary equipment. A confidential, third-party fiduciary, Vault Consulting, LLC, compiles the monthly data and analyzes individual company data for consistency and accuracy. Once this crucial process is completed, Vault aggregates and disseminates reports to participating companies.

The Plastics Industry Association (PLASTICS), is the only organization that supports the entire plastics supply chain, representing nearly one million workers in the $451 billion U.S. industry. Since 1937, PLASTICS has been working to make its members and the industry more globally competitive while advancing recycling and sustainability. To learn more about PLASTICS' education initiatives, industry-leading insights and events, networking opportunities and policy advocacy, and North America's largest plastics trade show, NPE: The Plastics Show, visit plasticsindustry.org.

Source: PLASTICS